Zenith Bank continues to showcase robust financial performance despite Nigeria’s challenging macroeconomic environment. In the first half of 2024, the bank reported a 117% year-on-year growth in gross earnings, surging from ₦967.3 billion in H1 2023 to ₦2.1 trillion in H1 2024. This strong top-line growth also reflected in their profit before tax (PBT), which soared by 108%, from ₦350 billion to ₦727 billion during the same period. Likewise, profit after tax (PAT) experienced a substantial rise of 98%, reaching ₦578

Key financial metrics indicate Zenith’s focus on operational efficiency and its ability to navigate a high-interest rate environment. The net interest margin (NIM) grew 49% year-on-year to 8.8%, while the cost-to-income ratio saw only a slight increase to 39.4%, demonstrating the bank’s efficient cost management. Despite rising interest expenses due to high interest rates, Zenith’s interest income crossed the ₦1 trillion mark for the first time.

Total assets grew by 35% from ₦20.4 trillion in December 2023 to ₦27.6 trillion in June 2024, while customer deposits increased by 29%, from ₦15.2 trillion to ₦19.6 trillion. This solid growth also extended to the bank’s loan portfolio, which grew 44%, driven in part by the favorable foreign currency exchange effects on loans.

Analysts remain optimistic about Zenith Bank’s long-term growth potential. Despite a slight rise in non-performing loans from 4.4% to 4.5%, the bank’s strong liquidity and capital adequacy ratios of 64% and 23%, respectively, place it in a strong position to weather market volatility and continue its expansion plans.

The chart above shows that Zenithbank has completed wave 3 in Q1 24. The unfolding structure is a correction for the Wave 4 with a potential target of 33.16. At the moment, we a tracking a triangle in the Wave 4 position, with the completion of A and B waves. If the count is correct then we should see further weakness to the Wave C position between 30 and 33.16.

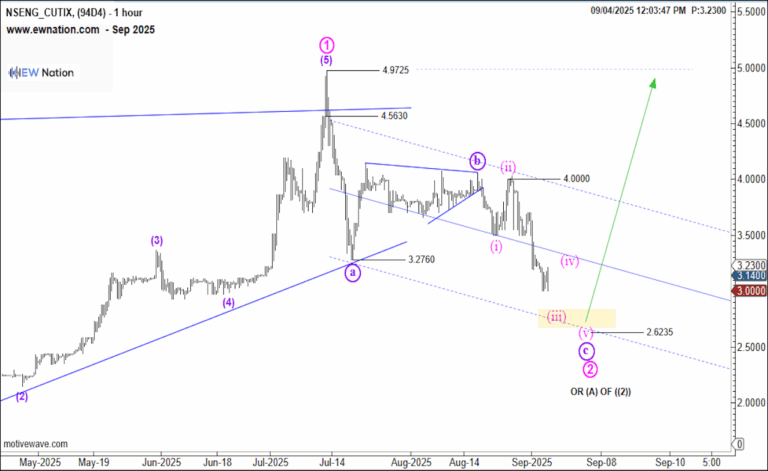

The Elliot Wave chart below shows that Neimeth has completed wave 4 and making progress towards wave 5. The unfolding correction is in 3 waves and is a subwave 2 with a target around the 1.77 region before the uptrend will resume again.