Fidelity Bank (Ticker: FIDELITYBK) Financial Analysis: A Corrective Phase with Reversal Potential?

Fidelity Bank (FIDELITYBK), one of Nigeria’s leading financial institutions, has experienced steady growth in recent years, driven by its robust portfolio of retail and corporate banking services. The bank has expanded its presence across Nigeria, offering a wide range of products including savings, loans, and investment services, while also playing a key role in financing small and medium-sized enterprises (SMEs) and supporting the digital banking transformation in the country.

In 2023, Fidelity Bank reported a strong financial performance, with revenue increasing to ₦335 billion, up 21% from the previous year. The bank’s profits rose accordingly, underpinned by higher net interest margins and increased customer deposits. Its solid capital base and focus on efficient cost management allowed the bank to maintain healthy operating margins, giving it resilience amidst Nigeria’s challenging macroeconomic environment. Fidelity Bank’s stock has seen significant appreciation in recent years, reflecting these positive developments, with the share price reaching a high of ₦7.50 in 2023.

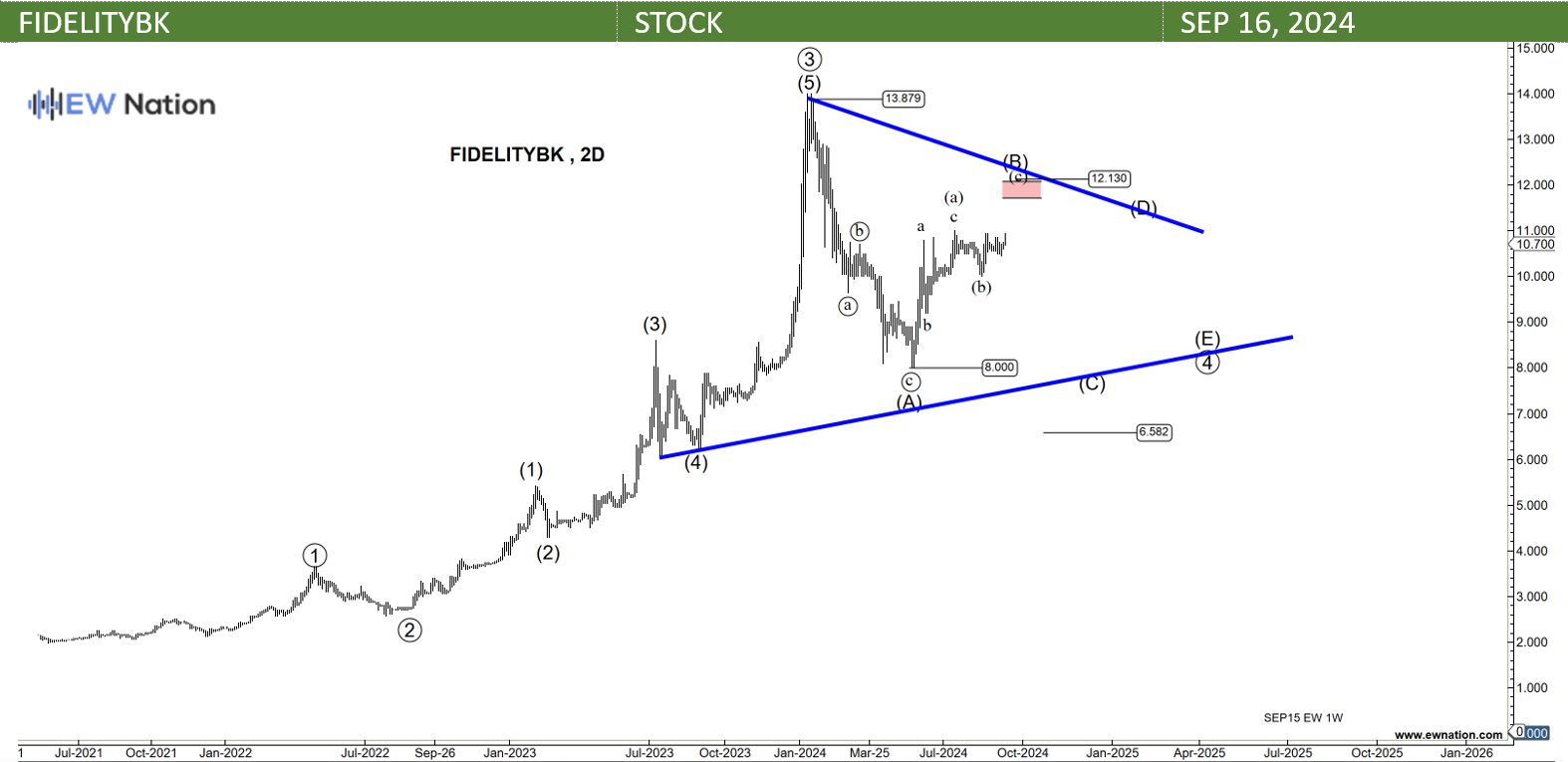

However, market sentiment around Fidelity Bank has recently shifted into a corrective phase. Technical analysis indicates that the stock, after a strong bullish run, may be poised for a short-term pullback. According to analysts using Elliott Wave Theory, Fidelity Bank’s stock appears to be entering a corrective wave, suggesting that the upward momentum is losing steam. Investors have started to take profits, leading to increased volatility and short-term price corrections.

Currently, Fidelity Bank’s price-to-earnings (P/E) ratio stands at 3.9, lower than the industry average, signaling that despite recent gains, the stock is not excessively overvalued. However, the corrective signals in the market are worth noting for investors, as the stock appears to be approaching near-term resistance levels.

Despite the potential for a short-term pullback, Fidelity Bank’s long-term outlook remains promising. The bank continues to benefit from Nigeria’s growing demand for digital and financial inclusion services, especially in the retail and SME sectors. Moreover, Fidelity Bank’s ongoing efforts to strengthen its digital banking platform and expand its customer base provide strong growth prospects.

In the short term, however, investors should be cautious of the current corrective sentiment. Analysts suggest that a potential reversal could occur after the correction, offering a buying opportunity once the stock consolidates at lower levels. The corrective phase may be a healthy reset, allowing Fidelity Bank’s share price to stabilize before resuming its upward trend

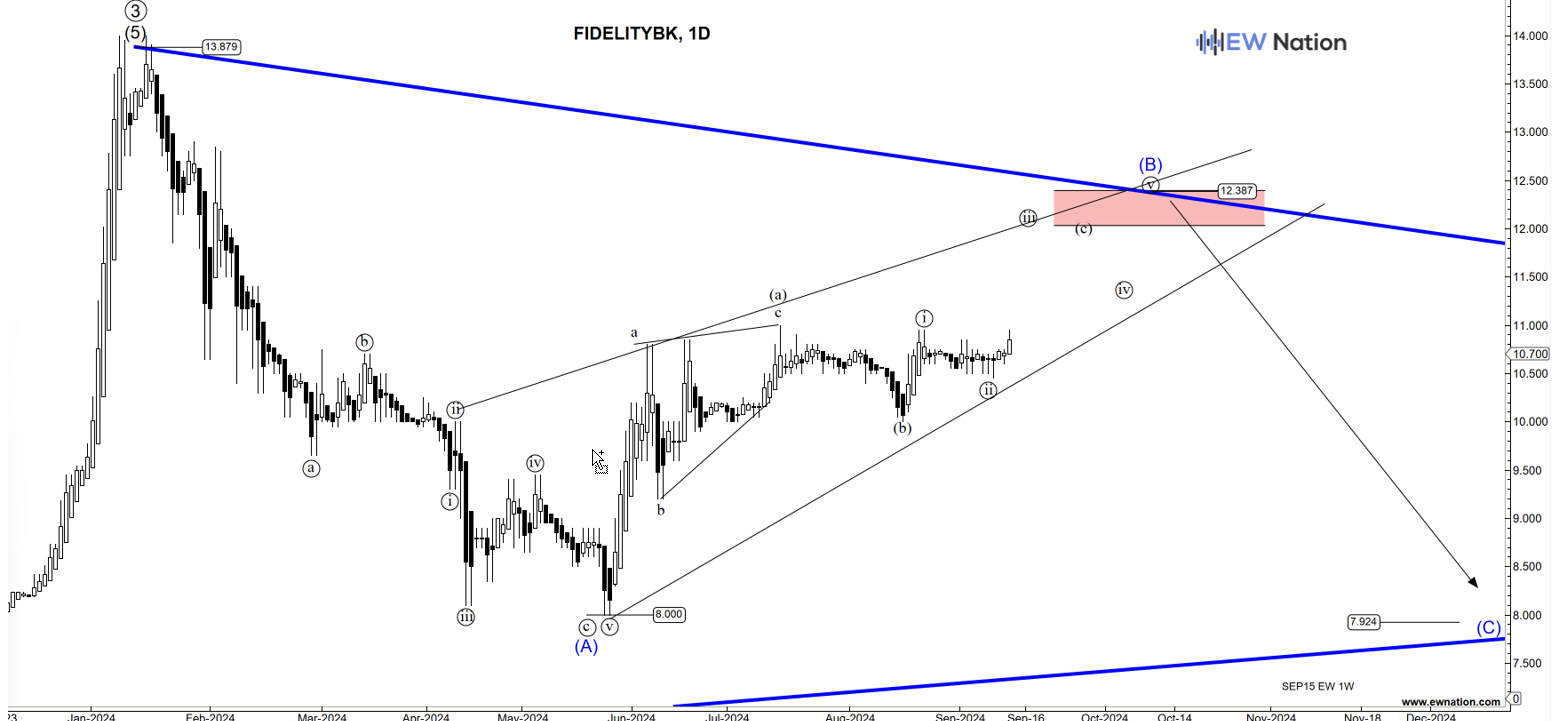

The Two day Elliot Wave chart above shows that FidelityBk is in a wave 4 correction which may be taking the form of a triangle labeled (A)-(B)-(C)-(D)-(E). The pattern is currently progressing in a wave (B) as shown below.

If this count is correct, then we should see further weakness upon completion of this move to around 12.5 region.