Air Transport Services Group (ATSG) is a leading provider of air cargo transportation and related services in the United States. Specializing in leasing cargo aircraft, providing airline operations, and offering maintenance and logistics services, ATSG primarily serves major e-commerce companies, including Amazon, as well as express delivery carriers like DHL. The company plays a critical role in the global supply chain, enabling fast and efficient cargo transportation for its clients.

Founded in 1980, ATSG has grown significantly, adapting to the rising demand for air cargo services, especially in the e-commerce sector. The company’s fleet includes Boeing 767s and 757s, which it leases to customers while also providing crew, maintenance, and insurance (CMI) services. The company has expanded its operations through strategic acquisitions and partnerships, solidifying its position in the air cargo industry.

ATSG’s stock has performed well over the past decade, benefiting from the boom in online shopping and the increased reliance on air freight for fast delivery. Despite facing some short-term headwinds due to fluctuating fuel prices and global economic uncertainty, ATSG remains well-positioned for long-term growth due to continued demand for air cargo services and its strong relationships with key e-commerce players.

Investors considering ATSG should recognize its strategic role in the e-commerce logistics ecosystem, while also weighing factors such as economic shifts and fuel price volatility that could impact its performance.

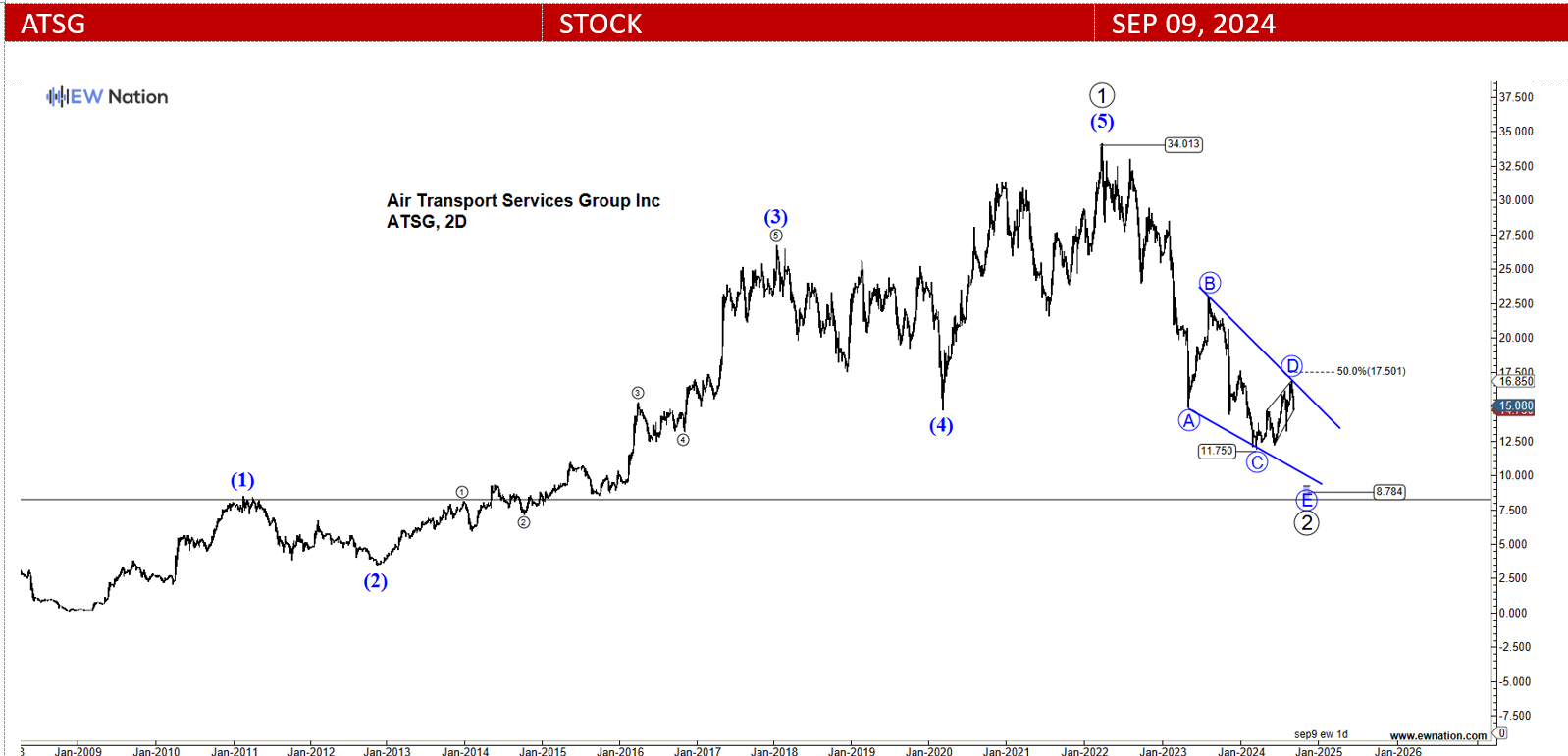

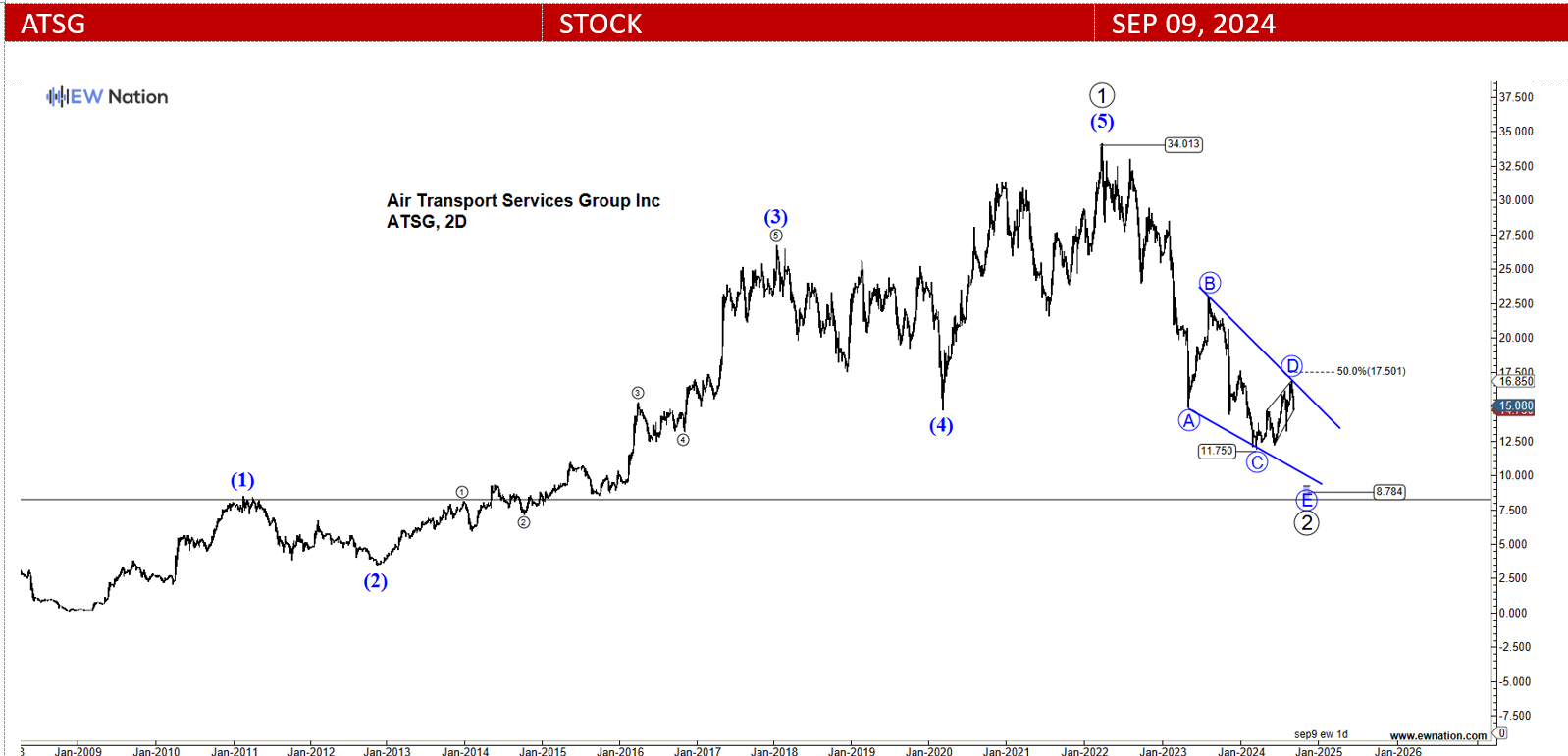

The Two day chart above shows that ATSG produced a textbook five-wave impulse between 2009 and 2023. The pattern is labeled 1-2-3-4-5, where two lower degrees of the trend are visible in wave 3 and Wave 5 is an ending diagonal. According to the Elliot Wave theory, a three wave correction follows every impulse. And indeed, once wave 5 ended, the bears took charge and dragged the stock to 11.75 in Q2 2024.

Once again, Wave C of the unfolding retracement is forming an ending diagonal with a target at around the 8.784 region signifying the completion of the retracement, then the resumption of the larger uptrend would make sense.