AMN Healthcare is a $4.7B company and a leading provider of healthcare workforce solutions and staffing services in the United States. AMN serves a variety of clients, including hospitals, clinics, and other healthcare facilities, by offering services such as nurse staffing, physician placement, locum tenens services, and other specialized healthcare professionals. With a growing demand for healthcare talent, AMN plays a critical role in addressing workforce shortages within the healthcare industry.

AMN Healthcare went public in 2001, around the time when the healthcare industry was undergoing rapid changes due to regulatory reforms and technological advancements. Since its IPO, AMN has been able to grow significantly both organically and through strategic acquisitions, becoming a dominant player in the healthcare staffing and workforce solutions market. Over the past two decades, the company has shown resilience, especially during periods of economic uncertainty, where the demand for healthcare professionals has remained strong.

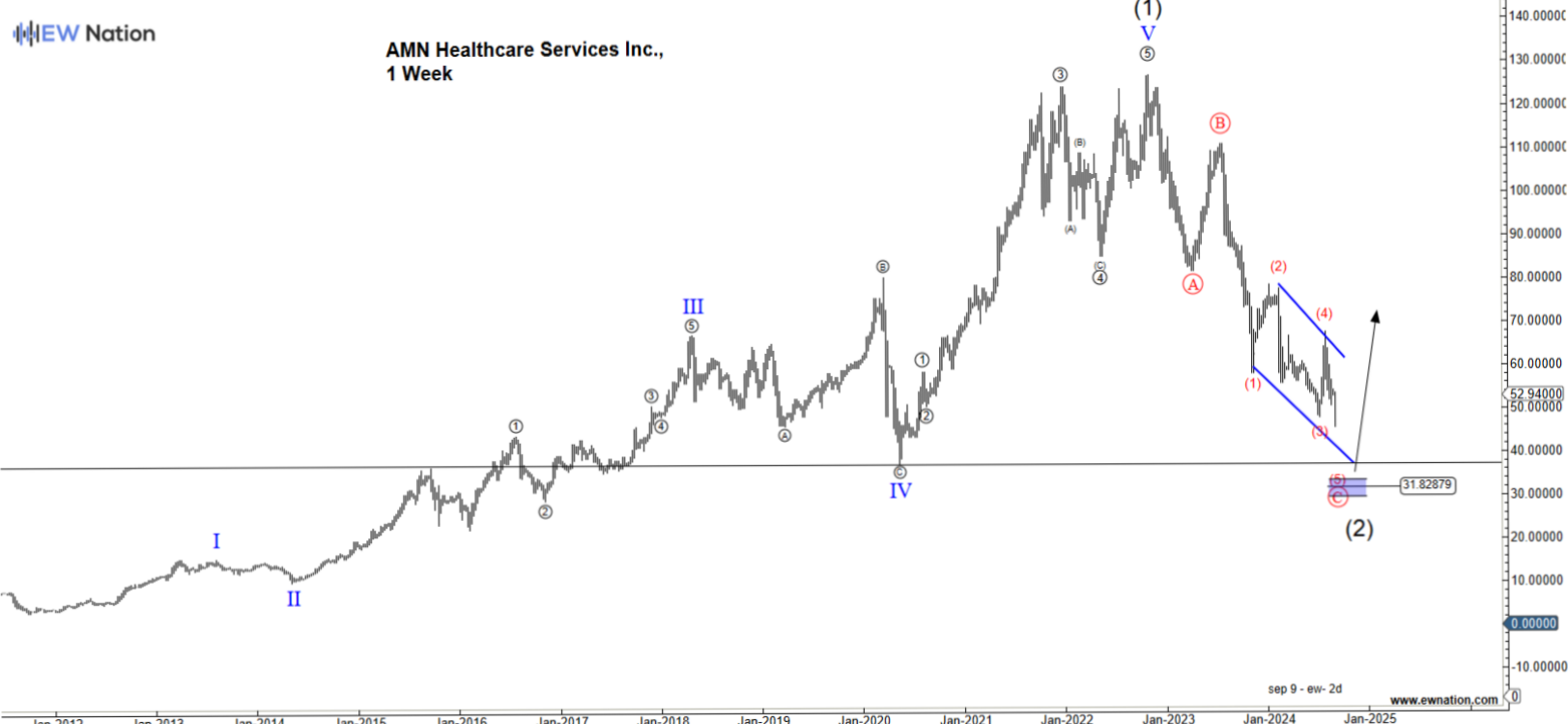

In terms of stock performance, AMN Healthcare has delivered solid returns to investors. Between 2012 and its 2022 high, the stock surged from around $8 per share to a peak of $129.12, reflecting the strong growth in healthcare demand and AMN’s strategic positioning in the market. However, more recently, the stock has pulled back, currently trading at approximately $99 per share, down around 23% from its all-time high in 2022.

Despite this recent decline, AMN’s financials remain strong. The company has consistently grown its revenue, with a 10-year compound annual growth rate (CAGR) of around 12%, driven by increasing demand for healthcare services. AMN has also maintained a healthy balance sheet, with manageable debt levels and robust free cash flow generation. As of the most recent quarter, AMN reported revenue of $2.22 billion, a slight decline from the previous year due to normalizing demand following the COVID-19 pandemic surge. However, its long-term outlook remains favorable due to ongoing workforce shortages in the healthcare sector.

Is the recent dip a buying opportunity? Given AMN’s solid fundamentals, strategic acquisitions, and long-term demand drivers in healthcare staffing, the current weakness could offer a chance to enter a quality company at a discount. However, with the broader economic uncertainties and rising labor costs, investors may want to monitor further developments before committing to a long-term position.

In summary, AMN Healthcare remains a vital player in the healthcare staffing market, with strong financials and a bright long-term outlook despite short-term headwinds.

The Weekly chart above shows that AMN Healthcare produced a textbook five-wave impulse between 2012 and 2023. The pattern is labeled I-II-III-IV-V, where two lower degrees of the trend are visible in wave III and wave V is an ending diagonal. According to the Elliot Wave theory, a three wave correction follows every impulse. And indeed, once wave V ended, the bears took charge and dragged the stock to 45 in Q3 2024.

Once again, Wave C of the unfolding retracement is forming an ending diagonal with a target at around the 31 region signifying the completion of the retracement, then the resumption of the larger uptrend would make sense. Also this location 31 region signify a strong support for this asset.