The financial markets can be both exhilarating and frustrating. Traders often spend months perfecting strategies, only to find out they don’t always work as expected. This can lead to disillusionment, with some even abandoning the market altogether. Among the myriad of strategies, one that continues to spark debate is the Elliott Wave principle. Critics question its reliability, while proponents swear by its ability to predict market behaviors accurately. But does it still hold up in today’s volatile markets? Let’s explore its relevance, effectiveness, and the psychology behind its application.

The Skepticism Surrounding Elliott Wave

Elliott Wave theory has its fair share of skeptics. Many traders and analysts doubt its efficacy, arguing that the patterns it identifies are too subjective and open to interpretation. The complexity of the theory can lead to inconsistency, where different analysts may interpret the same market data in entirely different ways. This subjectivity fuels the belief that the Elliott Wave principle might be more of an art than a science, raising questions about its practical application in real-world trading.

Yet, despite the skepticism, the Elliott Wave principle has endured for decades, with many traders continuing to rely on it to guide their decisions. So, what is it about this theory that keeps it relevant?

The Power of Predictive Accuracy

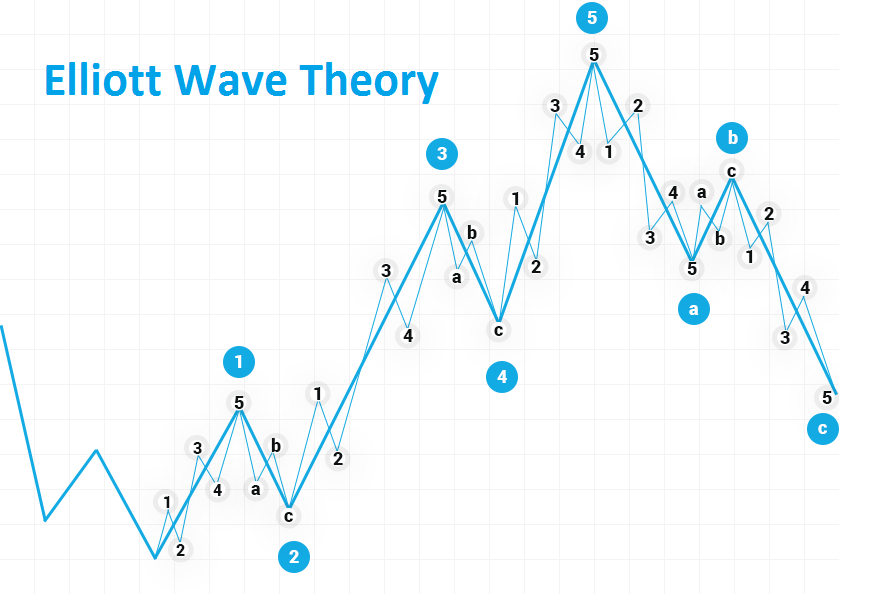

At its core, the Elliott Wave principle is based on the idea that market prices move in predictable wave patterns, driven by collective investor psychology. According to the theory, markets move in five waves during a trend (three in the direction of the trend and two corrective waves) and in three waves during a counter-trend. This pattern, when identified correctly, can offer valuable insights into future market movements.

While it may not be foolproof, many traders find that the Elliott Wave principle provides a framework that, more often than not, accurately predicts market behavior. The key lies in the principle’s connection to market psychology and the concept of herd mentality.

Market Psychology and Herd Mentality

The Elliott Wave principle aligns closely with the psychological aspects of trading. Markets are not just driven by economic data and company fundamentals; they are also deeply influenced by human emotions like fear, greed, and euphoria. These emotions often cause investors to act in herds, buying or selling en masse, which creates patterns in the market that the Elliott Wave theory seeks to identify.

For instance, during a bull market, the majority of investors may become overly optimistic, pushing prices higher and forming the impulse waves described by Elliott. Conversely, in a bear market, fear takes over, leading to sharp declines and corrective waves. The ability of the Elliott Wave principle to capture these emotional cycles gives it a psychological edge that can make it an effective tool for traders who understand and respect its intricacies.

Navigating the Market with Elliott Wave

To be successful with Elliott Wave analysis, traders must not only learn the theory but also exercise patience and discipline. One of the most common mistakes is seeing patterns where none exist, a tendency driven by the human brain’s natural inclination to find order in chaos. Traders must resist the urge to force patterns onto charts and instead wait for clear, well-formed waves before making a move.

This cautious approach is akin to that of a seasoned investor who waits for the right moment to buy or sell, rather than reacting impulsively to every market fluctuation. Understanding that not every market situation fits neatly into the Elliott Wave framework is crucial. The theory is most effective when applied to well-defined trends, and traders who can distinguish between clear and ambiguous patterns will have a better chance of success.

Embracing the Imperfections

It’s important to acknowledge that no trading method, including Elliott Wave analysis, is perfect. Even the most seasoned Elliott Wave practitioners encounter situations where the market does not behave as anticipated. External factors, such as unexpected news events, can disrupt patterns and lead to losses. However, this does not negate the value of the Elliott Wave principle.

The true strength of Elliott Wave analysis lies in its ability to provide a structured approach to understanding market movements. By accepting that no method is infallible and that losses are an inevitable part of trading, traders can focus on long-term success rather than short-term perfection. This mindset is essential for navigating the uncertainties of the financial markets.

Conclusion: Is It Still Worth It?So, does the Elliott Wave principle still work in practice? The answer is a resounding yes, but with a caveat. It requires a deep understanding of market psychology, discipline in its application, and the patience to wait for clear patterns to emerge. While it may not provide guaranteed success in every trade, its ability to capture the ebb and flow of market emotions makes it a valuable tool for those who take the time to master it.In the end, like any trading strategy, the Elliott Wave principle is only as effective as the trader using it. Those who approach it with realistic expectations, respect its limitations, and combine it with sound risk management practices will find it a powerful ally in navigating the complex world of financial markets.